DeFi flash loans are gaining huge traction these days in the crypto space. What once seemed absurd a few years ago has become a reality since their introduction by the Ethereum-based open-source bank called Marble. However, it was the DeFi lending protocol, Aave, that helped these loans gain popularity in 2020. It is because the DeFi flash loans have no cap on the borrowing amount; soon Aave started issuing about $100 million of them every single day. But that is not the only factor contributing to the rise in popularity of DeFi flash loans.

Industry experts even claim these loans are some of the most innovative tools in the crypto trading market. However, what exactly are DeFi flash loans and how do they operate?

This article flash loans the basics, such as how DeFi flash loans work and the most common applications.

DeFi Flash Loans Explained

DeFi flash loans are unique, unsecured, and uncollateralized loans that allow users to borrow assets with no upfront collateral. However, they require the assets to be returned within the same blockchain transaction. Furthermore, these uncollateralized loans do not involve central banks or intermediaries; instead, smart contracts handle loan execution and ensure contract compliance. Many DeFi lending platforms, including MakerDAO, Aave, and Uniswap, provide smart contract lending to users all over the world.

In crux;

- DeFi flash loans are uncollateralized and unsecured, as they don’t require collateral.

- These loans are built on blockchain technology and utilize smart contracts for executing transactions.

- They don’t have long-term interest repayment schedules, since the funds are borrowed and repaid within a single transaction.

How Do DeFi Flash Loans Work?

As previously stated, DeFi flash loans do not require collateral, and unlike secured loans, they do not even require a high credit score. Flash loans operate using smart contracts, as follows:

- The process starts through the borrower’s end, who applies for a flash on the DeFi lending platforms.

- A smart contract is developed outlining the intended use of funds, the desired loan amount, and the repayment terms.

- Following contract execution, the lending platform transfers funds to the borrower in the requested amount.

- Now, the borrower can use funds for different purposes, such as trading, arbitrage, buying, and more, as mentioned earlier in the smart contract.

- In the same blockchain transaction, funds are transferred to the lender along with borrowing fees.

- The lender can now verify that they have received the full amount. If the payment is incomplete, the smart contract will automatically reverse the complete transaction.

What Is The Use Of DeFi Flash Loans?

Check out some of the use cases of DeFi Flash Loans:

Flash loan arbitrage

In arbitrage trading, traders make use of the price difference between two markets for the same cryptocurrency asset. To invest in these trading opportunities, they frequently use flash loans to borrow money and earn a quick profit.

For example, if token A costs $1,000 on platform X and $1,100 on platform Y, a trader can use a flash loan to purchase token A on platform X and sell it on platform Y. It would help them make a profit of $100.

Self-liquidation

Now, that is not what crypto traders aim for, but in order to avoid liquidation, traders sometimes self-liquidate a bad position with a flash loan. Moreover, it turns out to be much cheaper than paying liquidation fees.

Collateral Swaps

In order to improve their borrowing circumstances, users sometimes move their collateral between lending platforms. For example, if a borrower has WBTC on Compound but wants ETH, they can swap it using a flash loan.

What Are The Benefits Of Flash Loans?

Here are some of the benefits of flash loans, making them so desirable option for lending:

- DeFi flash loans improve capital efficiency by facilitating smart contract lending without any collateral.

- They provide the quickest access to the desired loan amount with no paperwork or additional hassles.

- These loans have extremely low transaction fees, which easily outweigh the profit made from borrowing money.

- DeFi platforms don’t demand to have a perfect or even any credit profile for loan eligibility.

- These loans make it possible for traders to profit from arbitrage opportunities.

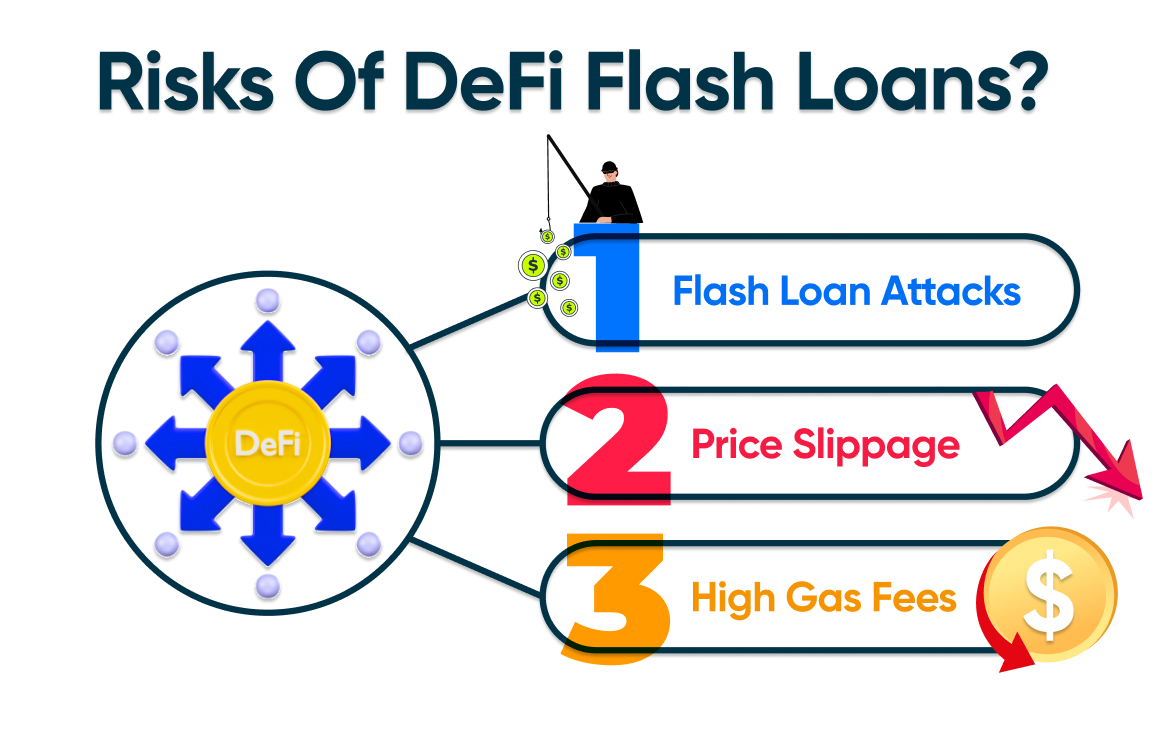

What Are The Possible Risks Of DeFi Flash Loans?

No doubt DeFi cash loans present massive opportunities for users, but they have their own risks, such as:

Flash Loan Attacks:

These are fairly common, and hackers use smart contract errors to manipulate and exploit flash loans. The same occurred in 2020’s bZx attack, in which hackers used flash loans to manipulate prices, resulting in a $350,000 loss.

Price Slippage:

Borrowers mostly use the funds gained through flash loans for arbitrage trading to earn from market dislocations. However, in the case of unfavorable price movements, there could be a major loss of funds.

High Gas Fees:

It requires significant gas fees to carry transactions in a DeFi space. As this gas fee is dynamic in nature, sudden spikes can cause loss even on successful arbitrage opportunities.

What Occurs If Borrowers Fail To Make Their Flash Loan Payments?

If a borrower doesn’t pay back the DeFi flash loan on time, it results in major consequences such as:

- All actions taken by the borrower using the borrowed funds are automatically undone, and the transaction is reversed.

- Even if the transaction is reversed, the broker still needs to pay the transaction fees.

- In case the trader used a flash loan to repay for collateral, they would lose the collateral.

- Particularly for a borrower who is heavily involved in the cryptocurrency market, nonpayment can result in harm to one’s reputation.

Wrapping Up

DeFi flash loans offer numerous benefits by providing opportunities for MEV (Miner Extractable Value) strategies, including arbitrage, liquidations, and collateral swaps, among others. However, the open nature and poor smart contract development practices make flash loans vulnerable to exploitation. These risks can be mitigated by creating secure and effective smart contracts that facilitate safer transactions. Thus, only a security-first approach can help DeFi adapt to new risks and build user trust.

Stay connected with Webcom Systems to learn about more DeFi possibilities!

Recommended Read: What Technologies Power Crypto Arbitrage Bot Development?