The past years have witnessed an unprecedented boom in Blockchain Technology, which has revolutionized the way we store and transact data. Blockchain is an ideal system for fintech that brings about transparency, security as well as speed.

According to market research firm Statista, expenditure on blockchain solutions globally has already grown by 6.6 billion dollars in 2021. It is estimated to climb over 39 billion U.S. dollars in size by 2025. This data indicates a growing recognition and acceptance of blockchain across various sectors particularly in finance.

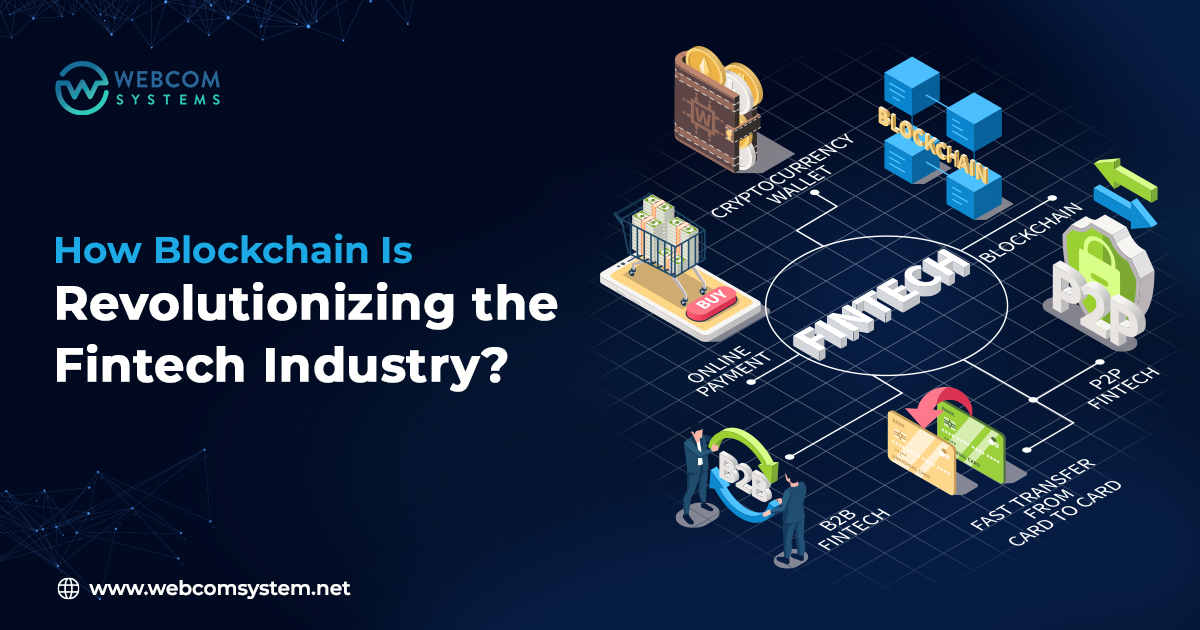

In this blog post, we are going to examine how blockchain is revolutionizing the fintech sector.

What is Fintech & Blockchain? How Does It Work?

Fintech, short for financial technology, is the use of innovative technology in the financial sector to improve and automate financial services. It covers a wide array of applications including online banking, mobile payment solutions, peer-to-peer lending, and cryptocurrencies.

Blockchain, on the other hand, is a decentralized and distributed ledger technology that forms the base of cryptocurrencies such as Bitcoin. It functions by linking each block in an unbroken chain, with each block containing a list of transactions linked together cryptographically. Blockchain technology ensures secure, transparent and immutable record keeping thereby removing third-party intermediaries from transactions.

The functionality of Blockchain depends on consensus algorithms, cryptographic hashing and peer-to-peer networking. When there is a new transaction, it is verified by network participants through mining which involves solving complex mathematical problems to add the transaction into a new block.

This block then becomes part of the existing chain creating an everlasting tamper-proof record of all transactions made. The decentralization feature of Blockchain guarantees that data can be accessed by everyone in a secure manner hence it is also fraud resistant or manipulation free.

What is The Role of Blockchain in the Fintech Industry?

Now, let’s delve into the roles and give examples of how blockchain is reforming the financial sector.

Decentralization and Trust:

The decentralized structure of Blockchain eliminates intermediaries, thereby allowing direct peer-to-peer transactions. The platform Bitcoin for example uses a blockchain to carry out secure and transparent transactions without involving traditional financial institutions. By fostering trust among participants through transparency and immutability, blockchain increases the level of trust between participants by bypassing intermediaries who otherwise would have been necessary to verify such transactions.

Streamlined Payments and Remittances:

Blockchain-based solutions have transformed cross-border payments and remittances. Ripple, a blockchain-powered platform, allows faster and more cost-effective international payments by directly linking financial institutions. Through simplifying payment processes for businesses and individuals by reducing transaction fees and removing multiple intermediaries, blockchain facilitates low-cost cross-border transactions which are also efficient.

Improved KYC and Identity Verification:

Blockchain is a secure and efficient way to deal with Know Your Customer (KYC) procedures. Platforms like SelfKey make use of blockchain technology in order to enable users to store and manage their identity documents securely. Financial institutions can access this data with the user’s permission, which makes the KYC process much quicker but at the same time ensures that data privacy and security are maintained.

Efficient Supply Chain Financing:

Blockchain improves supply chain financing by making transparency and traceability better. TradeLens platform from IBM together with Maersk Company uses blockchain to digitize global trade processes and hence improve them. With each transaction securely recorded as well as the movement of goods made on a blockchain platform, it lowers the risk of fraud while providing lenders with correct as well as reliable supply chain data so that they may offer better financing terms for businesses.

Enhanced Peer-to-Peer Lending:

Blockchain technology allows peer-to-peer lending without intermediaries, which fundamentally changes the lending space. Platforms like ETHLend use blockchain smart contracts to automate loan agreements and remove the need for traditional financial institutions. Borrowers and lenders can transact directly, cutting costs and improving accessibility for those who may not meet traditional credit criteria.

Promoting Financial Inclusion:

One of the most significant roles of blockchain in fintech is its potential to promote financial inclusion. Blockchain technology provides access to financial services through mobile devices and digital wallets thus enabling people who lack traditional banking infrastructure to participate in the financial ecosystem. For example, Moeda is a platform based on blockchain that promotes crowdfunding and microloans thus giving power to underserved populations in emerging economies.

Benefits of Blockchain in Fintech

The adoption of blockchain technology in the fintech comes with a host of benefits.

Enhanced Security and Transparency

One of the main merits of blockchain technology is its superior security and transparency features. Blockchain’s decentralized nature guarantees that multiple nodes record and validate all transactions, making it practically impossible for a single entity to manipulate the data. This kind of transparency not only prevents fraud and unauthorized activities but also fosters trust between users.

Increased Efficiency and Cost Savings

In traditional financial systems, intermediaries and manual processes cause delays and increase costs. With blockchain technology, financial transactions are confirmed and verified within seconds which in turn obviates the need for middlemen as well as redundant processes. This process helps in cutting down on costs, thereby making financial services more affordable and accessible to everyone.

Rise in Accessibility and Financial Inclusion

Blockchain technology can provide financial services to unbanked and underbanked people across the world. Blockchain technology creates a decentralized platform where there is no need for traditional banking infrastructure so that individuals can have power over their finances independently. This results in greater financial inclusion hence more people can take part in the global economy.

Smart Contracts and Automation

Smart contracts that are based on blockchain allow the creation and execution of self-executing agreements without any need for an intermediary. Digital contracts automatically enforce themselves once predefined conditions are met, eliminating the need for manual intervention or legal intermediaries. This not only speeds up the process but also reduces errors plus costs related to traditional contract management.

Enhanced Compliance Procedures

Fintech companies face many regulatory requirements that are both complicated as well as time-consuming to comply with. Through the application of blockchain technology, financial transactions may be recorded transparently and immutably thus making it easier for regulatory bodies to audit as well as monitor activities. Fintech Companies use this strategy to make compliance processes smoother hence lowering the risk of non-compliance.

Conclusion

The blockchain technology is a game changer in fintech that provides a secure, transparent and efficient way to process financial transactions. Blockchain revolutionizes financial services delivery by offering a myriad of benefits such as enhanced payments, lending, security, and cost-effectiveness. Despite challenges that still exist, the prospects of blockchain in fintech are quite bright for more innovative solutions and disruption in the future. If you’re looking for a fintech service that can help you stay ahead, please visit our website at Webcom Systems to learn more about our services.

Also Read: The Power of Tokenization for Protecting Sensitive Data