Blockchain technology has been around for more than a decade! Instead of limiting itself to a typical set of applications, this technology has evolved significantly in recent years. It has impacted the way the financial industry operates since day one of its inception. Blockchain-based platforms open new possibilities and help improve business operations while reducing costs for financial institutions. But there is more that goes into it when we consider blockchain in finance! This blog will explore what makes blockchain development so beneficial and also cite different financial applications.

Importance of Blockchain Development In Finance

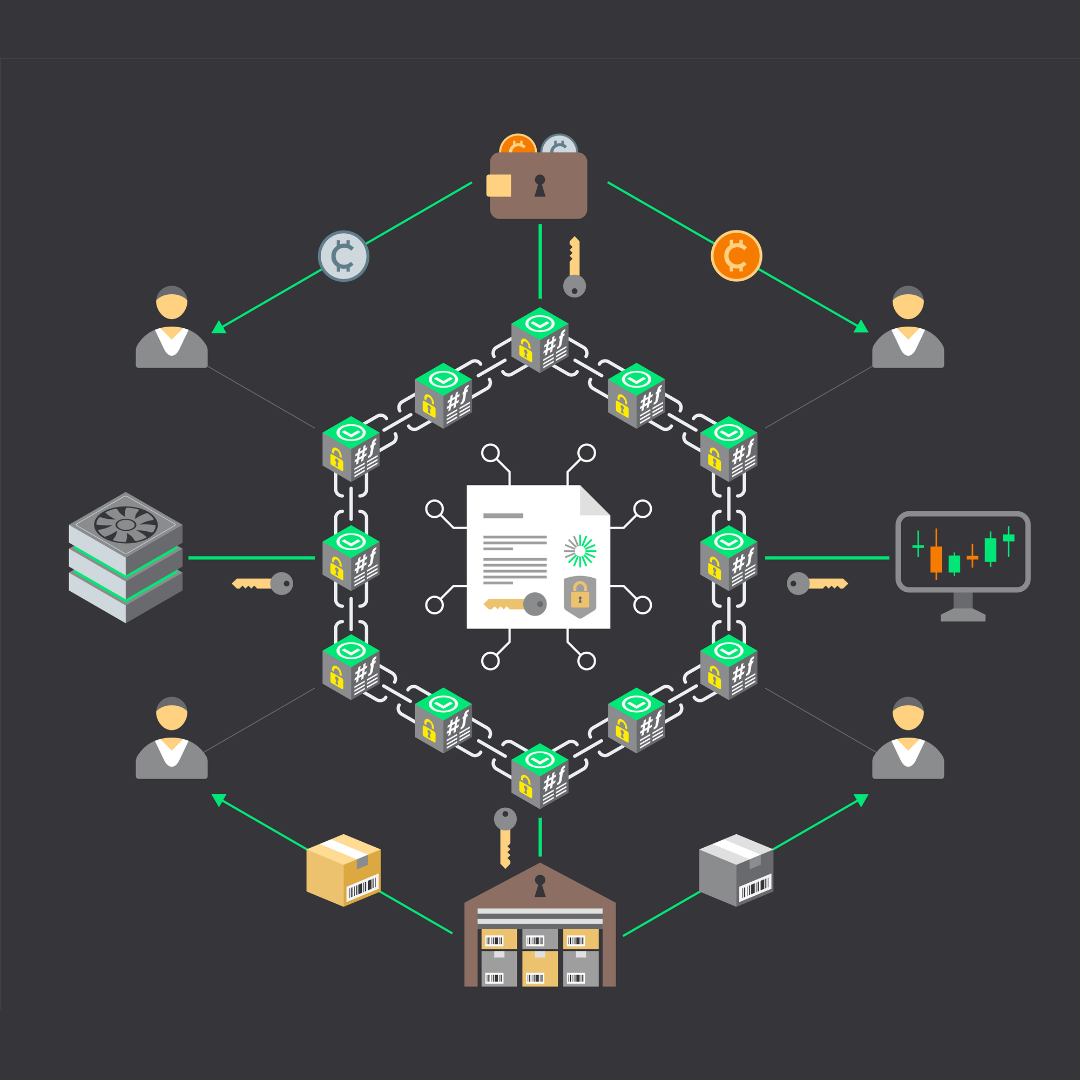

Blockchain is a distributed ledger technology that records transactions and shares them across a network of computers. Blockchain development aids in leveraging decentralization, immutability, transparency, and other blockchain capabilities by building innovative applications and systems. Blockchain development has become extremely important for the finance industry by offering the following benefits through the integration of fintech and blockchain:

Enhancing Transparency

All transactions recorded on the blockchain network are completely transparent and even verifiable by all network participants holding authorized access. This open visibility to the ledger helps build trust and ensure accountability, as every activity is traceable and permanent.

Cutting costs

Blockchain for financial services enables automation that allows companies to operate independently, eliminating the need to involve central authorities or intermediaries. It also aids in cutting the cost for first businesses and eventually for customers as well.

Improving Operational Efficiency

Leveraging smart contract development services, businesses can automate their routine processes. It not only eliminates the possibility of human error, which is critical in the financial sector, but also improves operational efficiency.

Enhancing Traceability

Expertly developed blockchain solutions enhance traceability in financial operations by creating a complete, decentralized, and tamper-proof record of all transactions on the distributed ledger. It protects data from fraud and ensures that all necessary regulations are followed when providing financial services.

Adding Personalisation

Financial services and products can be easily customized with the help of smart contracts by setting them according to desired requirements and functionality.

Increasing Security

Blockchain technology inherits immutability, transparency, and decentralization to deliver security in financial operations. Moreover, with the use of cryptography techniques and other advanced security features, shared data is protected from unauthorized access or fraud.

Accelerating Transactions

Transactions that traditionally used to take days and even weeks due to the involvement of multiple intermediaries and inherited complexities can be concluded instantly with blockchain-powered systems. It is usually made possible with automation delivered by smart contracts.

Increasing Accessibility

Blockchain solutions allow financial service providers to broaden their services across borders and even serve remote areas, improving financial inclusion and scaling up their customer base.

Key Use Cases Of Blockchain For Financial Services

Blockchain development has not only introduced new financial services, but it has also improved existing ones by upgrading traditional systems. Here are the common use cases of blockchain for financial services:

Trading

Earlier, businesses used to operate centralized exchanges that were vulnerable to hackers. Blockchain in Finance has introduced:

- Decentralized exchanges (DEXs) that are operated by customized smart contracts allow financial institutions to provide peer-to-peer trading services without involving any intermediary parties.

- Apart from basic DEXs, Decentralized derivatives are also available that can include various financial instruments (options and futures.) Due to blockchain incorporation, the whole trading process is transparent and secure.

Uniswap is a leading decentralized cryptocurrency exchange. Integrated with Ethereum wallets, it allows users to easily trade digital assets.

Digital Identity Management

Most financial service companies are obliged to follow KYC policies to verify the identity of their customers. This identity verification and management helps in reducing risks related to fraud and money laundering and prevent any other illegal activities on their platform.

However, this process is time-consuming and cumbersome for companies, and it is even complex for customers to carry multiple documents and follow multiple verification criteria.

With blockchain development, it is so much easier to stay compliant with KYC and anti-money laundering laws. Blockchain-powered verification systems automate the identity verification process and securely store the data on an immutable and decentralized network.

HSBC Holdings plc is a British universal bank and financial services group that has integrated blockchain to streamline and automate its KYC process.

Insurance

Companies in the insurance industry can use blockchain technology to improve the transparency and efficiency of their claims verification processes. For example, MetLife, an Indian insurance company, uses blockchain-powered systems to automate payments. They have also simplified their life insurance claims management process to increase efficiency of their business operations.

Digital Payments

Financial institutions benefit by utilizing the new services presented due to advancements in blockchain development in fintech. Here’s how:

- Remittance service providers can use blockchain-based remittance solutions to improve speed and cost-effectiveness in cross-border transactions.

- Businesses can use tokenized fiat, stablecoins, and cryptocurrencies to transform their digital payments.

- Securities, as well as domestic wholesale payment networks, can be decentralized and ensure compliance with less manual intervention.

Many platforms, such as Coinbase, allow businesses to use cryptocurrencies for payments. Another example is BitPesa, a blockchain-powered foreign exchange and payment platform that facilitates easy cross-border payments from and to Africa.

Asset management

Companies that deal with private equity, real estate, and capital markets are bound by so many liabilities and changing regulations. Thus, complying with these obligations is too difficult for these companies, but blockchain-based asset management products improve asset and stakeholder management. Also, they can be personalized with built-in privacy settings to secure the financial transactions even further.

Bankex is an asset management system that is powered by blockchain technology, which overcomes market challenges. From real estate to securities, almost all types of real-world assets can be tokenized for better liquidity and fractional ownership.

Fraud Reduction

As the financial industry is prone to fraud, blockchain has assisted in overcoming this with its immutable, decentralized, and transparent ledger. Transactions recorded on the blockchain are verifiable and permanent as they can’t be altered or deleted.

JPMorgan Chase & Co., a well-known American multinational financial company, uses blockchain development solutions to enhance their payment systems and boost transaction security.

Wrapping Up

Blockchain development has brought big changes in the financial applications, and that too for all the good reasons. Fintech companies are using the decentralized and transparent nature of the blockchain ledger to enhance trading, asset management, regulatory compliance, and more. With blockchain integration, businesses can easily improve the security of their operations as well as cut operational costs, and increase overall efficiency.

If you are also looking to leverage the impressive capabilities of Blockchain and build blockchain-powered systems for your business, Webcom Systems can assist you. With our expertise in blockchain and fintech industries, we build solutions that bring the most out of these emerging technologies. Get in touch to learn more about our services.

Recommended Read: Can Blockchain and AI Work Together?